Real Estate Taxes

General Tax Information & Questions

The property tax process begins with the assessment which is conducted by the local assessor. The assessment represents the value of the property as of January 1 of each year. Property tax is calculated based on the assessed value. The tax bill is mailed out in early December of each year. Tax bills are mailed to the property owner of record. If you are no longer the property owner, consult your closing or title agent, as they usually have prorated the current year taxes for each party involved.

An installment option is available to all property owners with a tax bill greater than $100.

1st installments or full payments are due by January 31st paid to the Town of Byron Treasurer by mail or on site hours listed in notice mailed with the tax bill. Town of Byron Treasurer, N3097 State Rd 175, Brownsville, WI 53006.

Payments will be accepted in the form of check, cashier’s check or money order (NO CASH).

Verify that the escrow check meets or exceeds the tax bill amount and ENDORSE ESCROW CHECK if made out to you and the town of Byron. If the escrow check is more than the amount due, you will receive a refund check after I settle with the county. If less, include personal check to complete payment. Overpayments of less than $30 will not be issued refund, due to bank fees and administrative costs unless otherwise requested in writing. PLEASE CASH REFUND CHECKS ASAP

Town of Byron does not process tax payments after February 1st

2nd installment is due by July 31st. Mail to: Fond du Lac County Treasurer, P.O. Box 1515, Fond du Lac, WI 54936-1515

What is Considers a Timely Payment? A payment is considered timely if it is mailed in a properly addressed envelope with a U.S. Postal Service postmark, before midnight of the due date.

Additional tax information available on the Fond du Lac County website or by calling the Fond du Lac County Treasurer Office, 920-929-3010.

Contact the Town of Byron Treasurer for tax related questions.

Kay Murre 920-957-9057, treasurer@townofbyronwi.gov

Lottery Tax Credit online form

Real Estate Tax Information Online

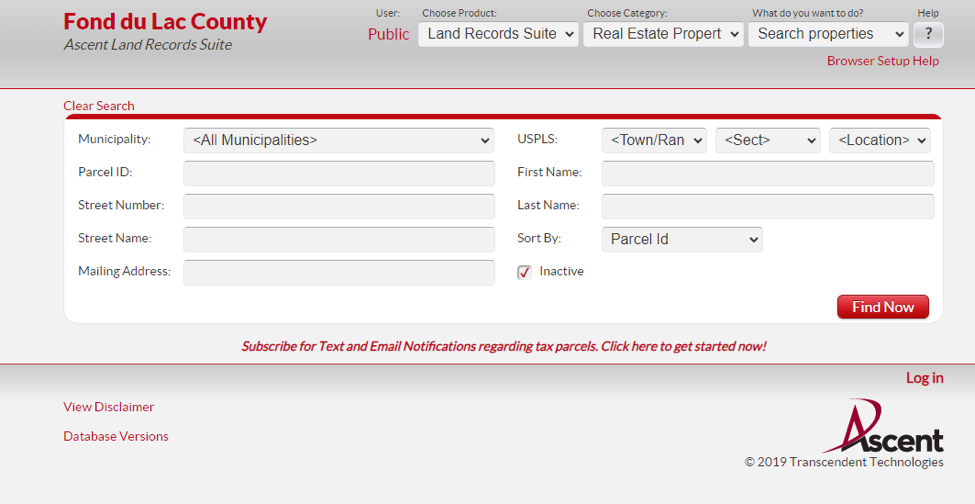

Subscribe for Text and Email Notifications regarding tax parcels. Click here to get started now!

Click here to view Real Estate Property Tax information.

How to search:

Optional -Municipality drop down select Town of Byron

Search by one of the following:

– Parcel Number, Site Address or Owner’s Name (Leave out spaces and punctuation when searching by parcel number)

Click on Parcel Number

Select Detail – Taxes

Duplicate Copy of a Tax Bill or Receipt

Go to Print tax bills section Click on Tax Year for that tax bill

For receipt Under Tax History

Click on tax year, then printer friendly link on pop up

Detailed Tax Payment Information or Receipt

Go to the History section and click on Tax Year

Only tax payments made after September 1, 2010 are displayed on this site.

Click on tax year, then printer friendly link on pop up